As a company’s potential profitability, or its expected growth rate, increases, the corresponding market value per share will also increase. A company can use a portion of its earnings to buy assets that would increase common equity along with BVPS. Or, it could use its earnings to reduce liabilities, which would also increase its common equity and BVPS. Market analysts and investors prefer a balance between the amount of retained earnings that a company pays out to investors in the form of dividends and the amount retained to reinvest into the company.

Book Value vs. Market Value: What’s the Difference?

Next, the beginning balance for the next period (Year 2) will be linked to the ending balance of the prior period (Year 1). By explicitly breaking out the drivers for the components of equity, we can see which specific factors impact the ending balance. Suppose we’re tasked with projecting the “Total Equity” line item of a company for a 3-year forecast period using roll-forward what is the difference between a ledger and a trial balance schedules. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy. Typically, the market value almost always exceeds the book value of equity, barring unusual circumstances. The following image shows Coca-Cola’s « Equity Attributable to Shareowners » line at the bottom of its Shareowners’ Equity section.

Book Value Greater Than Market Value

- Consider technology giant Microsoft Corp.’s (MSFT) balance sheet for the fiscal year ending June 2023.

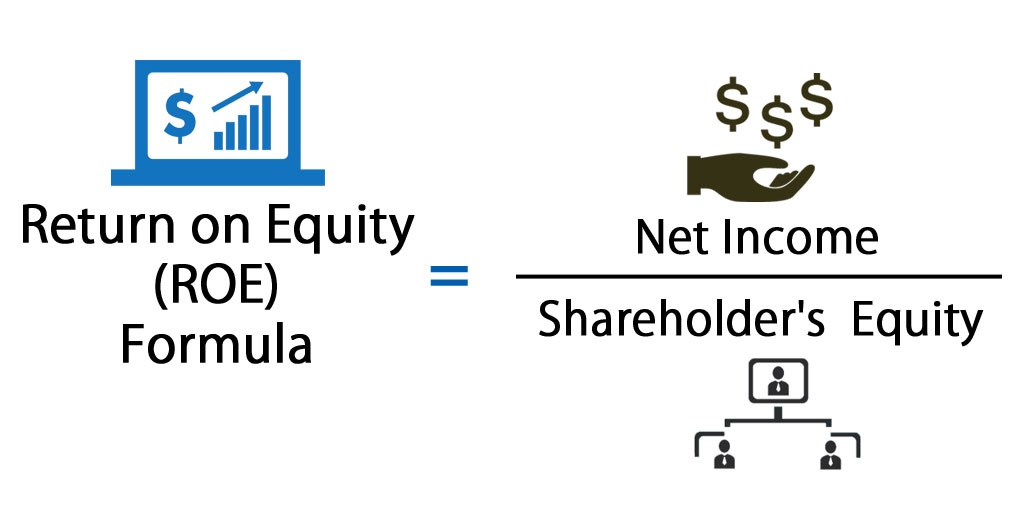

- If shareholders’ equity is positive, that indicates the company has enough assets to cover its liabilities.

- These repurchased shares are not canceled but rather held by the company as treasury shares in their books.

Companies with lots of real estate, machinery, inventory, and equipment tend to have large book values. In contrast, gaming companies, consultancies, fashion designers, and trading firms may have very little. They mainly rely on human capital, which is a measure of the economic value of an employee’s skill set. There is a clear distinction between the book value of equity recorded on the balance sheet and the market value of equity according to the publicly traded stock market. From the viewpoint of shareholders, treasury stock is a discretionary decision made by management to indirectly compensate equity holders. Next, the “Retained Earnings” are the accumulated net profits (i.e. the “bottom line”) that the company holds onto as opposed to paying dividends to shareholders.

Book Value of Equity vs. Market Value of Equity: What is the Difference?

Firstly, it helps to draw a comparative analysis with the actual prevalent share price of the company. Owners’ contribution are the funds that are directly paid by the owners (the shareholders) of the company to the company. As an accounting calculation, book value is different from an asset’s market value, which is contingent on supply and demand, and perceived value. The book value of equity (BVE) is calculated as the sum of the three ending balances. Remember that the markets are forward-looking and the market value is dependent on the outlook of the company (and industry) by investors. Repurchased shares are not factored in when calculating basic EPS or diluted EPS.

Income Statement

If the business has a total of 3,000 shares of common stock in issue then the book value of equity per share of common stock is calculated as follows. The book value of equity per share (BVPS) measures a stock’s valuation that allows investors to assess the financial health of a company. The BVPS can gauge whether a stock is undervalued or overvalued by using a snapshot of its current common equity and shares outstanding. Assume that XYZ Manufacturing has a common equity balance of $10 million and 1 million shares of common stock are outstanding. If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases.

Retained Earnings Calculation Example (RE)

Book Value of Equity is simply calculated by calculating the net figures of all the categories. They can either be readily available from the financial statements of the company, particularly the Balance Sheet (also referred to as Statement of Financial Position). Treasury Shares are the shares that the company has bought back from the existing shareholders. As opposed to cancelling those shares altogether, the company prefers to hold those shares, and represent them as treasury shares in the books of the company.

It can be defined as the net asset value of the firm or company that can be calculated as total assets, less intangible assets (goodwill, patents, etc.), and liabilities. Further, Book Value Per Share (BVPS) can be computed based on the equity of the common shareholders in the company. The good news is that the number is clearly stated and usually does not need to be adjusted for analytical purposes. As long as the accountants have done a good job (and the company’s executives aren’t crooked) we can use the common equity measure for our analytical purposes. In simplified terms, it’s also the original value of the common stock issued plus retained earnings, minus dividends and stock buybacks.

If XYZ Company trades at $25 per share and has 1 million shares outstanding, its market value is $25 million. Financial analysts, reporters, and investors usually mean market value when they mention a company’s value. When companies issue shares of equity, the value recorded on the books is the par value (i.e. the face value) of the total outstanding shares (i.e. that have not been repurchased). Otherwise, an alternative approach to calculating shareholders’ equity is to add up the following line items, which we’ll explain in more detail soon. Book value of Equity can define as the company’s common equity, which is simply the amount that is available to be distributed within the shareholders. However, the market value per share—a forward-looking metric—accounts for a company’s future earning power.